Section 33 of the CGST Act. PART III - ASCERTAINMENT OF CHARGEABLE INCOME Chapter.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Act Part.

. For the purposes of this section actual cost of planting means the aggregate of. And ii Second it provides some examples on arrangements which in CITs view have the purpose or effect of tax avoidance within the meaning of section. B in the case of machinery or plant- i where the machinery or plant is installed for the purposes of business of construction manufacture or production of any one or more of the articles or things specified in the list in.

In view of the recent disturbances in the North Eastern region of India CBDT has decided to extend the date for payment of 3rd installment of Advance Tax for FY 2019-20 from 15th December 2019 to 31st December 2019 for the North Eastern Region. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and. 1 This Part provides for personal reliefs.

After section 33AB of the Income-tax Act the following section shall be inserted with effect from the 1st day of April 1999 namely. Singapores GAAR are found in section 33 of the Income Tax Act and have been in place in their present form since 1988. ACT 53 INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002.

Ii the cost of seeds cutting and nurseries. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and. Section 33 Income-tax Act 1961.

Chapter 4Adjusted income and adjusted loss 33. Income Tax 5 Section 23. Income Tax Act 1947.

3 Appointment of Comptroller and other officers 3A Assignment of function or power to public body 4 Powers of Comptroller 5 Approved pension or provident fund or society 6 Official secrecy 7 Rules 8 Service and signature. Basis period to which gross income from a business is related. The assessee carrying on the business of prospecting extraction or production of petroleum or natural gas in India and depositing the amount in Special account or Site Restoration account is eligible to claim deduction under section 33ABA of the Income Tax Act.

2 Chapter 2 provides for entitlement to a personal allowance and a blind persons allowance. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting. I First it sets out the Comptroller of Income Taxs CIT approach to the construction of the general anti-avoidance provision in section 33 of the Income Tax Act ITA.

Notwithstanding anything contained in this Act or any other law for the time being in force where any supply is made for a consideration every person who is liable to pay tax for such supply shall prominently indicate. Chapter 4 - Adjusted income and adjusted loss Section. Long Title Part 1 PRELIMINARY.

INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. INCOME TAX By taxconcept December 16 2019 April 5 2020. Table of Contents.

1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by. 1 Short title 2 Interpretation. Held that the old section 33 was an annihilating section like section 260 of the Australia Income Tax Assessment Act 1936 and section 108 of the Land and Income Tax Act 1954 of New Zealand which was the prede cessor section to the current anti-avoidance provision section 99 of the Income Tax Act 1976.

Section 33 in The Income- Tax Act 1995. 1a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of. 1 Every registered taxable person other than an input service distributor or a nonresident taxable person or a person paying tax under section 9 section 46 or section 56 shall verify validate modify or if required delete the details relating to outward supplies and credit or debit.

The Income Tax Department NEVER asks for your PIN numbers. 47 of 1967 Date of coming into operation. The present article briefly lists down the conditions to be satisfied for claiming deduction under.

Amount of tax to be indicated in tax invoice and other documents. To-date there are two income tax cases dealing with the application of. Section 33 - Development rebate - Income-tax Act 1961.

I the cost of preparing the land. 3 Chapter 3 provides for tax reductions for married couples and civil partners F1 where a party to the marriage or civil partnership is born before 6 April 1935. Iv the cost of upkeep thereof for the previous year in which the land has been prepared.

33 Overview of Part. Section 331 of the Income Tax Act 1967 ITA reads as follows. Income Tax Department Tax Laws Rules Acts Income-tax Act 1961.

Tax on income of individuals and Hindu undivided family. Section 331 of the Income Tax Act 1967 ITA reads as follows. Iii the cost of planting and replanting.

1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with. Similar provisions exist in the Goods and Services Tax Act and the Stamp Duties Act. Furnishing details of inward supplies.

Section 33A 7 of Income Tax Act. Interpretation of sections 24 to 28 24. Ty per cent of the actual cost thereof to the assessee.

Section 33 of the CGST Act. Short title and commencement 2. Section 331 of the Income Tax Act 1967 ITA reads as follows.

To be the profits and gains of business or profession of that previous year and shall accordingly be chargeable to income-tax as the income of that previous year. He referred to the Privy Council.

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

Taxtips Ca Business 2020 Corporate Income Tax Rates

Taxtips Ca Canada Federal 2017 2018 Income Tax Rates

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

See For Yourself My Fellow Nigerian Follow Aniomablog On Ig And On Twitter Aniomablog Mirrored Sunglasses Men Mirrored Sunglasses News Video

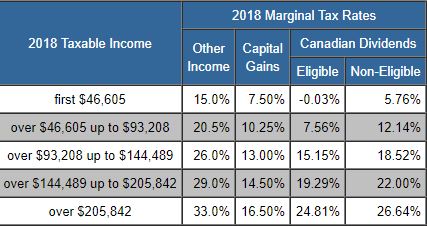

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

12a And 80g Renewal Society Trust Renew

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

Alert Companies Have Started Issuing Form 16 To File Your Taxes Have You Received Yours Click On The Image To Know Why You Ne Income Tax Income Employment

Form 33 Clearance Certificate Online Taxes Filing Taxes Tax Services

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

Genesis Of The Indian Taxation System Small Business Tax Business Tax Tax Refund

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Canada S Federal Personal Income Tax Brackets And Tax Rates 2022 Turbotax Canada Tips

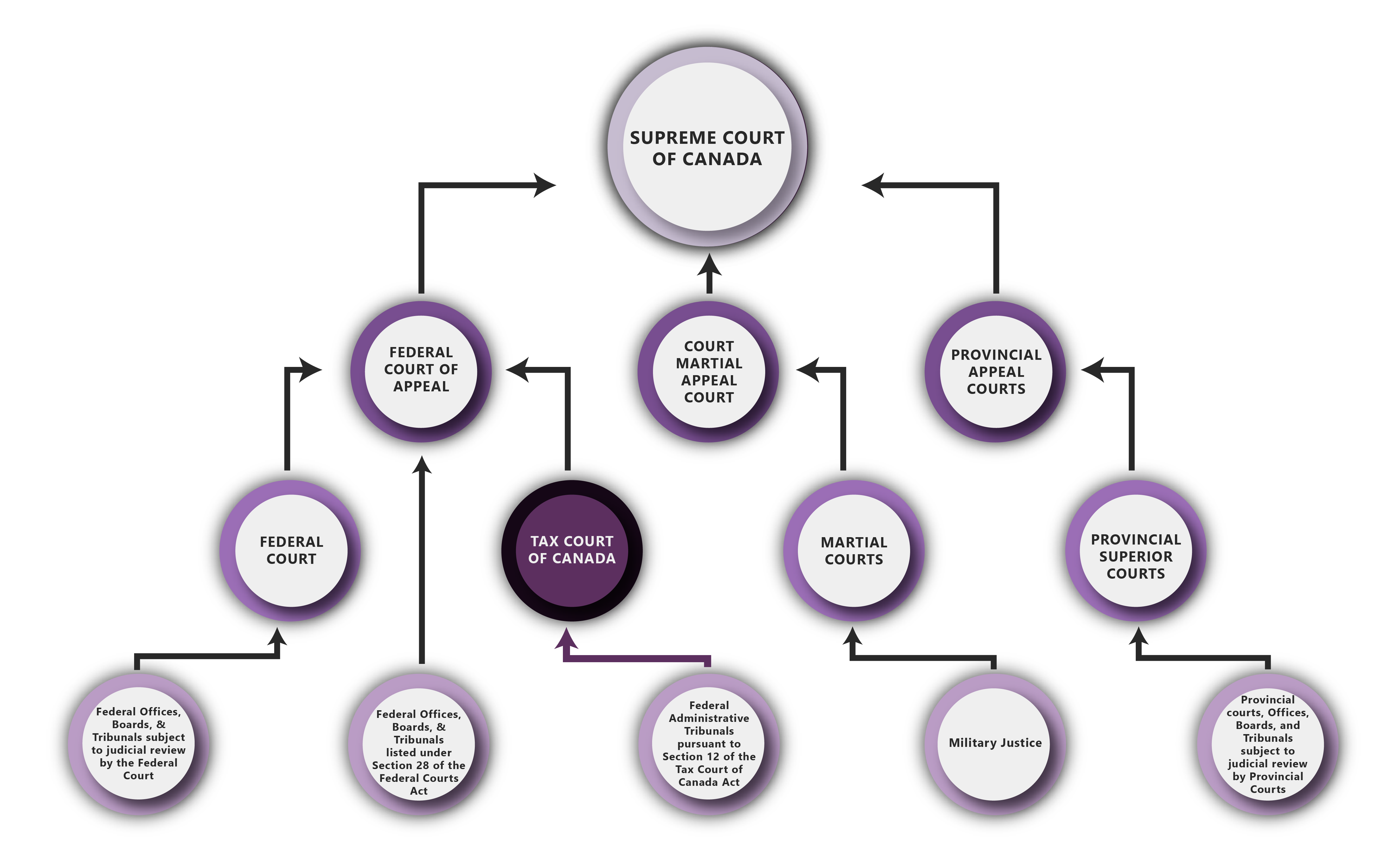

Tax Court Of Canada Jurisdiction